Nota: Cada acción realizada en la aplicación tiene un coste. Si no puede realizar las acciones recomendadas en los artículos que está viendo, es posible que no se hayan activado los permisos necesarios para su perfil de usuario. Contacte con el equipo de soporte o con su administrador para obtener más información.

Empezar desde: El menú de Easilys.

On Easilys, VAT is automatically applied according to the product family assigned to the products, since a product family is linked to an analytical group, itself linked to a VAT tax.

To manage other taxes, you need to create a specific supplier product bearing the name of the tax.

Ejemplo: I need to indicate the amount of the Interfel tax in my receptions this morning. So I'm going to manually add the INTERFEL product I created at the beginning of the year to my receptions. I modify its price list to indicate the amount of tax applied to my reception.

- Seleccione el Supplier orders > Receptions cortina a la italiana.

- Seleccione el delivery note you wish to sign off, for which a tax other than VAT is to be applied.

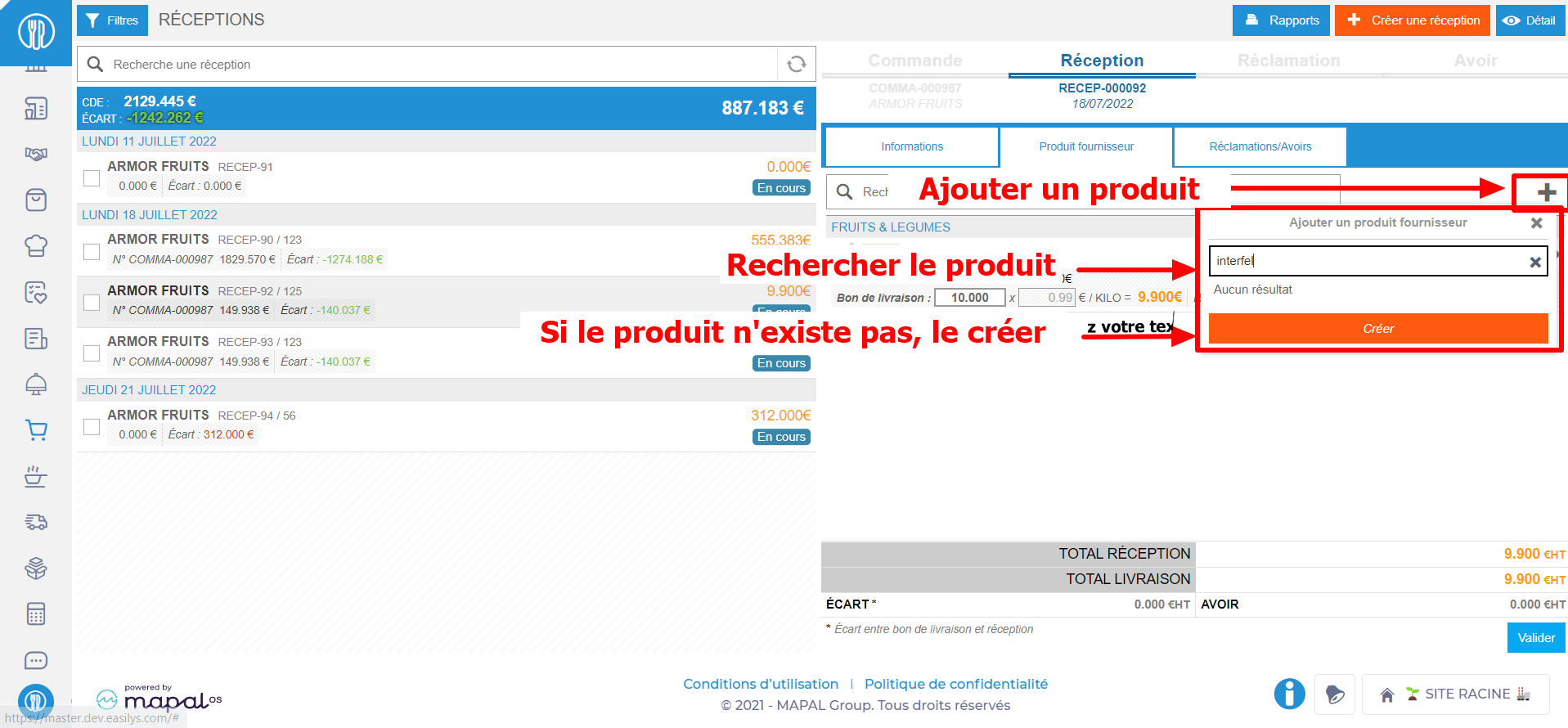

- Seleccione el + to manually add a product to the delivery note.

- Buscar the product bearing the name of the tax to be applied.

Nota: If you have not yet created this product, you can create it directly from the receipt. Create it once, and you'll be able to use it in all your User's receptions.

To find out more, see the article Create a product quickly from a reception.

Don't attach your product to an ingredient: it's not necessary, and it could cause problems in recipes and menus.

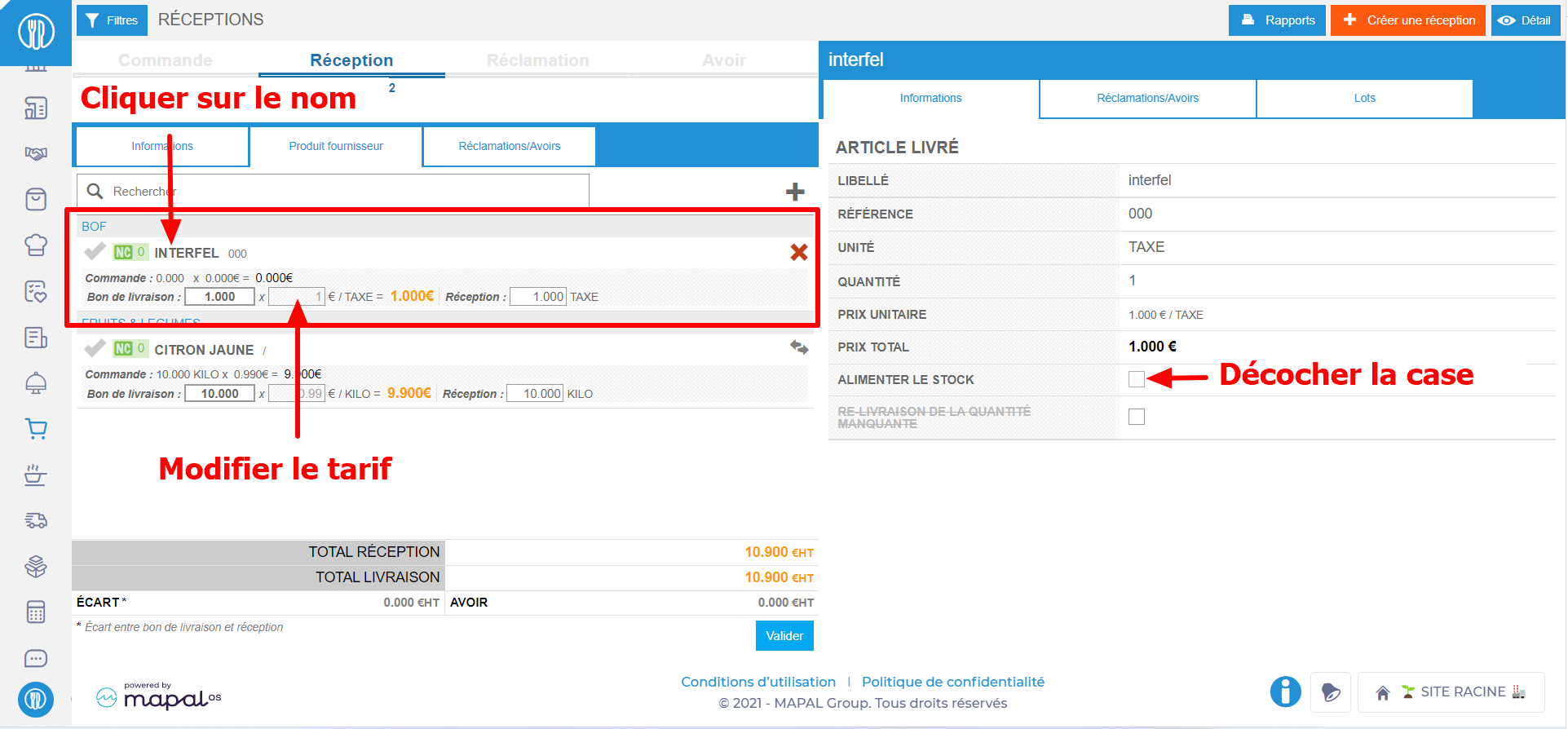

- Once the product has been added to your receptions, modify the price list to indicate the amount of tax applied to your order.

- Seleccionar the product name representing the tax to open its details.

- Uncheck the “Enter the stock” box if you do not want to add this product to stock.

- Seleccionar Save now.

Nota: you can bring your product representing the tax into stock, but you will have to remember to take it out of stock when you take out the product concerned by this tax, or set it to 0 when you do an inventory.

You can now resume validation of your receipt normally.